|

1 |

5(1 + R)^40 = 200 implies R = 0.0966 (9.66%) |

| |

|

|

2 |

|

| |

a. |

Company 1 now has $1.5 billion in assets $500 million in debt, and $1 billion in equity. Its leverage ratio is 1.5/1.0. |

| |

b. |

Company 1’s new debt creates a tax shield. |

| |

|

|

3 |

By the time the recession is over, stock prices will surely have recovered. Selling low and buying back high will just lock in this losses. |

| |

|

|

4 |

[Henry Blodget, “Why Wall Street Always Blows it,” The Atlantic, December 2008, 50-60.]

|

| |

a. |

A risk-averse buyer will not buy a riskier asset unless the expected return is sufficiently high. |

| |

b. |

Dividends increase over time, coupons don’t. |

|

c. |

Dividend-yields have stayed below coupon yields for 50 years now. |

| |

|

|

5 |

The prime rate is generally above the Treasury-bill rate because even the financially strongest corporations are not as credit worthy as the U.S. Treasury. This corporation will have a lower borrowing rate if the Treasury bill rate does not increase as much as the prime rate, so that the spread widens. Similar logic holds if interest rates fall. |

| |

|

|

6 |

|

| |

|

| |

|

7 |

Regression to the mean suggests that relative earnings forecasts are systematically too extreme—too optimistic for companies predicted to do well and too pessimistic for those predicted to do poorly. If analysts are, on average, excessively optimistic about the companies that they predict will have the largest earnings increases in earnings and overly pessimistic about the companies predicted to have the smallest increases, stock prices may be too high for the former and too low for the latter—mistakes that will be corrected when earnings regress to the mean relative to these forecasts. If so, stocks with relatively pessimistic earnings forecasts may outperform stocks with relatively optimistic predictions. |

| |

|

|

8 |

|

|

|

a. |

If the merger goes through, and the market price of ABC and XYZ at the time the merger is executed is P, then the profit is 100,000(P - 9) + 100,000(9.50 - P) = $50,000 |

|

|

b. |

The pre-announcement market value of ABC is $2,000 million; the pre-announcement market value of XYZ is $800 million, The conservation-of-value principal implies that, neglecting the effects of synergies, efficiencies, better management, and so on, together they will have a total market value of $28 million and 3 million shares outstanding, with an implied price per share of ($28 million)/(3 million) = $9.33. |

| |

|

|

9 |

This is very similar to the put-call parity condition |

|

|

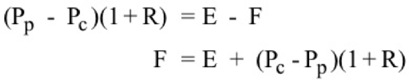

a. |

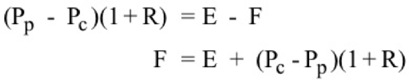

Buy the futures and the put and sell the call. If the value of the S&P 500 on the expiration date is P, then the cash received on the expiration date is E - F, no matter what the value of P:

|

P > E |

P = E |

P < E |

futures |

P - F |

E - F |

P - F |

put |

0 |

0 |

E - P |

call |

E - P |

0 |

0 |

total |

E - F |

E - F |

E - F |

|

|

|

b. |

In an efficient market, this guaranteed profit should equal the return R on a perfectly safe Treasury security that matures on the expiration date:

|

| |

|

|

10 |

According to CAPM, Ei - R0 = βi(EM - R0), so that an asset’s expected return is positively related to its beta coefficient/ Therefore, Asset 4 has the highest beta, then Asset 3, then Asset 2. |

| |

|

|

11 |

[Karen Damato, “Some Funds Fizzle in Hot Market,” The Wall Street Journal, November? 1996.] |

|

a. |

Long-term zero-coupon bonds have long durations and their market prices are consequently very sensitive to changes in interest rates. |

|

b. |

The strong economic news must have made traders wary either of renewed inflation that would push up interest rates or of an effort by the Fed to raise interest rates to slow the economy in order to prevent inflation. These higher interest rates are evident in the dumping of Treasury notes (prices down, yields up), and we know that higher interest rates pull stock prices down too. |

| |

|

| 12 |

If the target-payout fund’s return on assets is less than its minimum payout, it must make up the difference by selling some of the fund’s assets. The liquidation of assets is not the same as profits.

Suppose, for example, that a fund with $100 million in assets has a 7 percent target payout and that its net return on assets is 0 percent (perhaps a 3 percent dividend that is offset by a 3 percent capital loss). To make its 7 percent payout, it must sell 7 percent of the fund’s assets, reducing its assets from $100 million to $93 million. The fund’s shareholders receive $7 million in cash but the asset value of the fund they own has dropped by $7 million. Their net return is 0 percent. |

| |

|

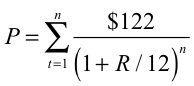

| 13 |

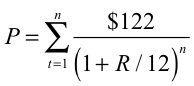

[Judy Feldman, “Moneyhelps,” Money, October 2003, p. 28.] This couple seems to have substantial assets and income. For the relatively small pension fund, a present value comparison is probably sufficient. They can compare the $24,000 lump sum to the present value of $122/month

where R is the required return and n is the number of months pension will last (presumably the number of months until the wife’s death. |

| |

|

| 14 |

[interview in In the Vanguard, Vanguard Marketing Corporation, Autumn, 1996.]Stock prices depend primarily on the anticipated cash flow and the required rates of return used to discount this cash flow. The anticipated cash flow depends on corporate profits; shareholder required rates of return depend on interest rates. Since their cash flow is fixed (except for default risk), bond prices depend only on interest rates. Ceteris paribus, an increase in interest rates will reduce the prices of both bonds and stocks; however, changes in corporate profits only affect stocks. |

| |

a. |

Thus when changes in interest rates cause changes in stock prices, bond and stock prices will be positively correlated. When changes in corporate profits cause changes in stock prices, the correlation between bond and stock prices will be virtually zero. |

| |

b. |

As explained in the answer to (a), bond and stock prices are either positively correlated or uncorrelated. Thus when R-squared is 0.36, R is +0.6. |

|

c. |

The relatively low correlation between bond and stock prices was used to argue that, for diversification, bonds should be added to a stock portfolio. |

| |

|

| 15 |

|

| |

a. |

The second stock because a growth stock has a longer duration than a no-growth stock. |

| |

b. |

The second stock because the higher the growth rate, the longer the duration. |

|

c. |

equal, because both are no-growth. |

| |

|

| 16 |

[Karen Damato, “Morningstar Edges Toward One-Year Ratings,” The Wall Street Journal, April 5, 1996.]

Past performance is not a reliable predictor of future performance. |

| |

|

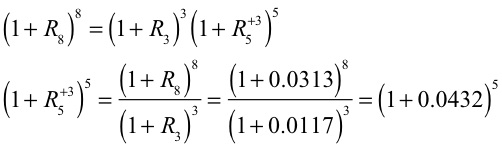

| 17 |

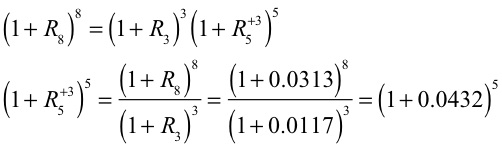

The Expectations Hypothesis implies that the 5-year rate 3 years from now is expected to be 4.32%

|

| |

|

| 18 |

|

| |

a. |

The total return from stocks should include dividends. |

| |

b. |

He should be using the return on zeros, not the interest rates. |

|

c. |

Looking forward, over a 1-year horizon, 1-year T-bills are risk-free. |

| |

|

| 19 |

[Ellen Florian Kratz, “Fear of Falling,” Fortune, December 26, 2005, p. 84.]

They are ignoring the fact that rents will increase over time while mortgage payments will not and that the interest portion of their mortgage payment is tax-deductible. They are also leaving out the property taxes, insurance, and maintenance expenses. |

| |

|

| 20 |

q = 1 since the market value of the fund’s share’s is equal to the net asset value per share. |